Saskatoon, SK, Canada, September 20, 2024 – Core Nickel Corp. (CSE: CNCO) (“Core Nickel” or the “Company”) is pleased to announce that it has closed its non-brokered private placement (the “Offering”) previously announced on September 13, 2024. Under the Offering, the Company has issued 8,000,000 flow-through units (the “FT Units”) at a price of $0.05 per FT Unit for gross proceeds of $400,000. Please see the September 13, 2024 news release for further information on the Offering.

All securities issued under this private placement are subject to a hold period expiring January 21, 2025, in accordance with applicable securities laws and the policies of the Canadian Securities Exchange.

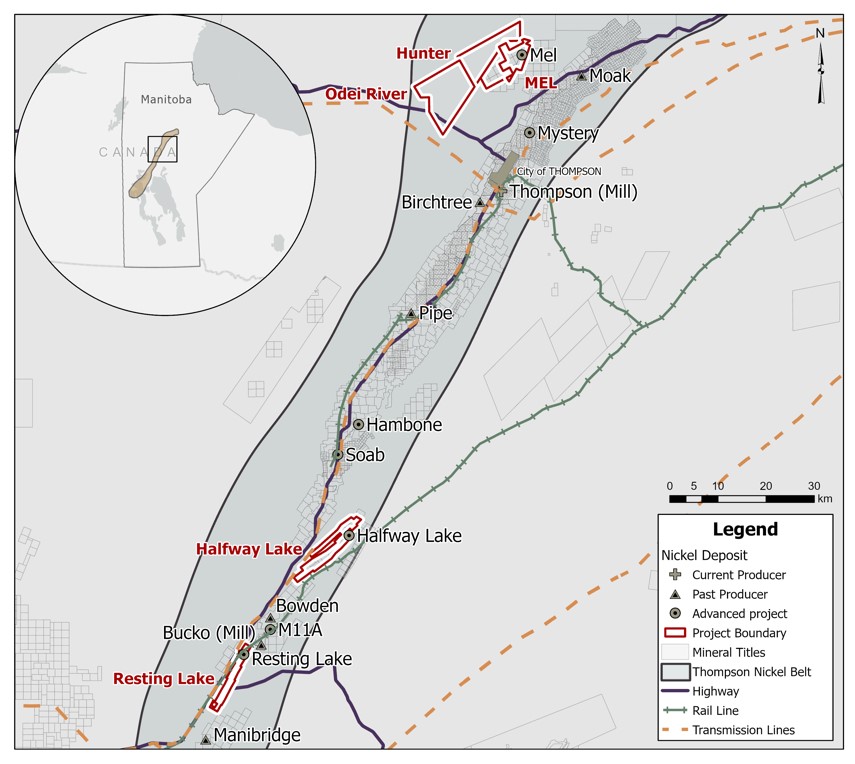

The gross proceeds received from the sale of the FT Units will be used for exploration programs on the Company’s projects in the Thompson Nickel Belt, Manitoba.

The Company’s 100%-owned Mel Deposit Project is located only 25 km from Vale’s operating Thompson Mill Complex. The Mel Deposit hosts a historic estimate with an indicated resource of 4.3 million tonnes grading 0.88% nickel and a historic inferred estimate of 1.0 million tonnes grading 0.84% nickel. The Mel Deposit has not been drilled since 2011 but is open for expansion both at depth and along strike.

The Company also owns 100% of the Halfway Lake Project, located only 15 km from the Bucko Mill. A preliminary 3-hole drill program completed by the Company in early 2024 intersected 91 metres grading 0.37% nickel with localized 1.0 m intersections grading over 1.0% nickel in drillhole HFW-002, from a vertical depth of approximately 120 metres. The Company believes this wide zone of shallow, ultramafic-hosted disseminated nickel-sulphide mineralization indicates potential proximity to a higher-grade massive sulphide zone, which is the typical host of the numerous past-producing and operating mines in the Thompson district.

Mr. Paul Reid purchased 4,000,000 FT Units under the Offering. Prior to the closing of this Offering, Mr. Reid owned or controlled 3,881,500 common shares of the Company, representing approximately 12.8% of the outstanding Core Nickel shares. Upon acquisition of the 4,000,000 FT Units, Mr. Reid now owns or controls 7,881,500 common shares of the Company, representing approximately 20.6% of the outstanding Core Nickel shares on a non-diluted basis. On a partially diluted basis (assuming the exercise of all 3,000,000 common share purchase warrants held by Mr. Reid), Mr. Reid would have ownership and control over approximately 26.3% of the then issued Core Nickel shares. The shares recently acquired by Mr. Reid are held for investment purposes only. Mr. Reid may acquire additional shares of Core Nickel or dispose of Core Nickel shares (through market or private transaction) from time to time. A copy of the related early warning report may be obtained under Core Nickel’s profile on the SEDAR+ website (www.sedarplus.ca) or from Mr. Reid at Suite 204, 75-24th Street East, Saskatoon, SK S7K 0K3.

Mr. Marc Pais purchased 4,000,000 FT Units under the Offering. Prior to the closing of this Offering, Mr. Pais held 229,000 common shares of the Company, representing approximately 0.8% of the outstanding Core Nickel shares. Upon closing of the Offering, Mr. Pais now owns or controls 4,299,000 common shares of the Company, representing approximately 11.2% of the outstanding Core Nickel shares on a non-diluted basis. On a partially diluted basis (assuming the exercise of all 2,000,000 common share purchase warrants held by Mr. Pais), Mr. Pais would have ownership and control over approximately 15.6% of the then issued Core Nickel shares. The shares recently acquired by Mr. Pais are held for investment purposes only. Mr. Pais may acquire additional shares of Core Nickel or dispose of Core Nickel shares (through market or private transaction) from time to time. A copy of the related early warning report may be obtained under Core Nickel’s profile on the SEDAR+ website (www.sedarplus.ca) or from Mr. Pais at Suite 204, 75-24th Street East, Saskatoon, SK S7K 0K3.

About Core Nickel

Core Nickel Corp. is a junior nickel exploration company that controls 100% of five properties in the prolific nickel district, the Thompson Nickel Belt (TNB) in Northern Manitoba, Canada. The five properties consist of approximately 27,000 hectares of land that is proximal to existing infrastructure, such as highways, railways, major hydroelectric transmission lines, and operating mills.

Core Nickel has a large contiguous land package in the northern part of the TNB, situated approximately 16-20 km from the City of Thompson. Core Nickel’s northern TNB projects consist of three properties: Mel, Hunter, and Odei River. The Mel property encompasses the Mel deposit, which is characterized by a historical NI-43-101 resource estimate with an indicated resource of 4.3 million tonnes at 0.875% nickel, equating to 82.5 million lbs contained nickel, and a historical inferred resource estimate of 1.0 million tonnes at 0.839% nickel, equating to 18.7 million pounds of contained nickel1. The target stratigraphy (Pipe Formation) that hosts the Mel deposit, and other deposits in the Thompson Nickel Belt, extend onto the Hunter and Odei River properties and drillhole intersections into the target stratigraphy on the Hunter project have successfully intersected elevated nickel.

Map: Core Nickel’s Thompson Nickel Belt Properties

The Company also holds two properties in the central TNB near Wabowden: Halfway Lake and Resting Lake. Both properties host the target Pipe Formation associated with known elevated nickel mineralization and are proximal to existing nickel deposits, mills, and other infrastructure.

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is Caitlin Glew, P. Geo., Vice-President Exploration for Core Nickel Corp., who has reviewed and approved its contents.

References

1 “Technical Report on the Mel Deposit, Northern Manitoba” prepared for Victory Nickel Inc, Shane Naccashian (P. Geo.) of Wardrop Engineering Inc., March 9, 2007

Technical Disclosure

The historical results contained within this news release have been captured from Manitoba Integrated Mining and Quarrying System (“iMaQs”) as available and may be incomplete or subject to minor location inaccuracies. Management cautions that historical results were collected and reported by past operators and have not been verified nor confirmed by a Qualified Person but form a basis for ongoing work on the subject properties.

On behalf of the Board of Directors

“Misty Urbatsch”

Misty Urbatsch

CEO, President and Director

Core Nickel Corp.

Contacts:

| Misty Urbatsch, CEO and President | General Enquiry |

| Tel: 306-668-6927 | Tel: 306-668-6927 |

| Email: [email protected] | Email: [email protected] |

Also find us online:

Neither the Canadian Securities Exchange nor its regulations services accept responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.