Core Nickel announces up to $1,500,000 Flow-Through Private Placement Financing

Saskatoon, SK, Canada, September 23, 2024 – Core Nickel Corp. (CSE: CNCO) (“Core Nickel” or the “Company”) announces that it proposes to undertake an up to $1,500,000 non-brokered private placement (the “Offering”) of flow-through units (each, a “FT Unit”) to be sold to eligible purchasers at a price of $0.30 per FT Unit. Each FT Unit will consist of one common share of the Company to be issued as a “flow-through share” within the meaning of the Income Tax Act (Canada) (each, a “FT Share”) and one common share purchase warrant. Each Warrant will entitle the holder to purchase one non-flow-through common share of the Company at a price of $0.30 at any time on or before that date which is 36 months after the closing date of the Offering.

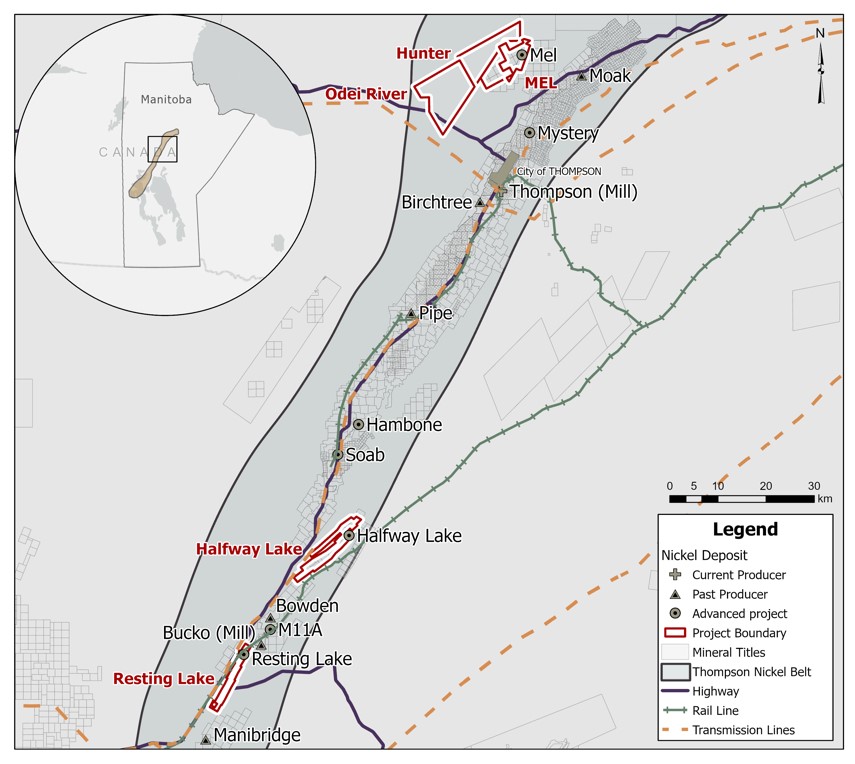

The gross proceeds received from the sale of the FT Units will be used to fund “Canadian exploration expenses” that qualify as “flow-through critical mineral mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) related to the Company’s properties in the Thompson Nickel Belt, Manitoba on or before December 31, 2025, and the Company will renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Shares effective December 31, 2024.

The Company’s 100%-owned Mel Deposit Project is located only 25 km from Vale’s operating Thompson Mill Complex. The Mel Deposit hosts a historic estimate with an indicated resource of 4.3 million tonnes grading 0.88% nickel and a historic inferred estimate of 1.0 million tonnes grading 0.84% nickel. The Mel Deposit has not been drilled since 2011 but is open for expansion both at depth and along strike.

The Company also owns 100% of the Halfway Lake Project, located only 15 km from the Bucko Mill. A preliminary 3-hole drill program completed by the Company in early 2024 intersected 91 metres grading 0.37% nickel with localized 1.0 m intersections grading over 1.0% nickel in drillhole HFW-002, from a vertical depth of approximately 120 metres. The Company believes this wide zone of shallow, ultramafic-hosted disseminated nickel-sulphide mineralization indicates potential proximity to a higher-grade massive sulphide zone, which is the typical host of the numerous past-producing and operating mines in the Thompson district.

The Company will pay finders’ fees to eligible finders in connection with the Offering, subject to compliance with applicable securities laws and the policies of the CSE.

Certain directors of the Company (the “Insiders”) may acquire securities in connection with the Offering. Such participation by Insiders is considered a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company expects that it will be exempt from the requirements to obtain a formal valuation and minority shareholder approval in connection with the Insiders’ acquisition of securities in reliance of sections 5.5(a) and 5.7(a) of MI 61-101, respectively, on the basis that the aggregate number of securities acquired by the Insiders will not exceed 25% of the fair market value of the Company’s market capitalization.

All securities issued and sold under the Offering will be subject to a hold period expiring four months and one day from their date of issuance in accordance with the policies of the CSE and applicable securities laws.

About Core Nickel

Core Nickel Corp. is a junior nickel exploration company that controls 100% of five properties in the prolific nickel district, the Thompson Nickel Belt (TNB) in Northern Manitoba, Canada. The five properties consist of approximately 27,000 hectares of land that is proximal to existing infrastructure, such as highways, railways, major hydroelectric transmission lines, and operating mills.

Map: Core Nickel’s Thompson Nickel Belt Properties

Core Nickel has a large contiguous land package in the northern part of the TNB, situated approximately 16-20 km from the City of Thompson. Core Nickel’s northern TNB projects consist of three properties: Mel, Hunter, and Odei River. The Mel property encompasses the Mel deposit, which is characterized by a historical NI-43-101 resource estimate with an indicated resource of 4.3 million tonnes at 0.875% nickel, equating to 82.5 million lbs contained nickel, and a historical inferred resource estimate of 1.0 million tonnes at 0.839% nickel, equating to 18.7 million pounds of contained nickel1. The target stratigraphy (Pipe Formation) that hosts the Mel deposit, and other deposits in the Thompson Nickel Belt, extend onto the Hunter and Odei River properties and drillhole intersections into the target stratigraphy on the Hunter project have successfully intersected elevated nickel.

The Company also holds two properties in the central TNB near Wabowden: Halfway Lake and Resting Lake. Both properties host the target Pipe Formation associated with known elevated nickel mineralization and are proximal to existing nickel deposits, mills, and other infrastructure.

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is Caitlin Glew, P. Geo., Vice-President Exploration for Core Nickel Corp., who has reviewed and approved its contents.

References

1 “Technical Report on the Mel Deposit, Northern Manitoba” prepared for Victory Nickel Inc, Shane Naccashian (P. Geo.) of Wardrop Engineering Inc., March 9, 2007

Technical Disclosure

The historical results contained within this news release have been captured from Manitoba Integrated Mining and Quarrying System (“iMaQs”) as available and may be incomplete or subject to minor location inaccuracies. Management cautions that historical results were collected and reported by past operators and have not been verified nor confirmed by a Qualified Person but form a basis for ongoing work on the subject properties.

On behalf of the Board of Directors

“Misty Urbatsch”

Misty Urbatsch

CEO, President and Director

Core Nickel Corp.

Contacts:

| Misty Urbatsch, CEO and President | General Enquiry |

| Tel: 306-668-6927 | Tel: 306-668-6927 |

| Email: [email protected] | Email: [email protected] |

Also find us online:

Neither the Canadian Securities Exchange nor its regulations services accept responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.